Rent Program | Frequently Asked Questions (FAQs)

Below are answers to some of the most frequent questions we receive. If you have a suggestion for our FAQs, please send it to the Rent Program. Click on a question below to see the answer.

The Rent Stabilization Ordinance is a City law that provides protection to renters who live in units covered by the RSO by regulating how often rent can be increased and how much the increase may be and by requiring landlord to send certain information to a renter before the rent may be increased. The RSO applies to rent increases that occur on or after August 23, 2022. The RSO does NOT apply to units that are exempt from the Ordinance.

The RSO also allows renters to file a Rent Reduction Petition with the City if they believe they are being charged more than what is allowed under the Ordinance. It also allows landlords to file a Fair Return Petition if they believe they have unusual circumstances that necessitate an increase above the maximum limit. The amount of rent charged at the beginning of a new tenancy is not limited by the Rent Stabilization Ordinance due to a State law limiting the City’s authority to regulate only rent increases and not initial rent.

Under the RSO, rent may be increased no more than one time in any 12-month period, and the amount of the increase may be no more than 3% or 60% of the Consumer Price Index for All Urban Consumers in the San Francisco-Oakland-Hayward Area published by the Bureau of Labor Statistics, whichever is less, of the rent charged at the time of the increase. The RSO does not apply to rental units that are exempt under the RSO.

The Rent Stabilization Ordinance can be found in Chapter 1 of Title 11 of the Antioch Municipal Code, beginning with Section 11-1.01.

Unless your rental unit falls under a category listed as exempt in by the Rent Stabilization Ordinance, it is protected by the RSO. This includes to any building or part of a building that is provided as a dwelling place in exchange for rent, even if it is not a legal rental unit. The list of categories of rental units that are exempt from the RSO may be found in Section 11-1.08 of the Rent Stabilization Ordinance and the Antioch Municipal Code and are discussed in another FAQ, below.

As a general rule of thumb based on the two most common exemptions, if a rental unit was built before 1995 and is on the same property as another residence (such as an apartment in an apartment complex or a duplex or triplex), the RSO probably applies. If a rental unit was built after 1995, or the rental unit could be sold separately from any other residence, the RSO probably does not apply.

More specifically, the RSO does not apply to any unit that first received a certificate of occupancy for the first time after February 1, 1995. This exemption would include an accessory dwelling unit that was certified for occupancy after this date. The RSO also does not apply to any unit that can be sold separately from any other unit. This exemption would include a single family home that was certified for occupancy before 1995. On the other hand, if an accessory dwelling unit was constructed on the property of single family home that was certified for occupancy before 1995, the single family home, if rented, would be subject to the RSO unless one of the other narrow exemptions applies. Whether the accessory dwelling unit in this example is subject to the RSO will depend on when the certificate of occupancy was issued.

The Rent Stabilization Ordinance limits the frequency and amount of rent increases. “Rent” incudes both monetary payments and nonmonetary payments made in exchange for a dwelling place. Nonmonetary payments include bartering goods or services, and the “amount” of nonmonetary rent is the fair market value of the goods or services. “Rent” also includes payments made for any and all services provided by a landlord that are related to the use and occupancy of the rental unit, such as parking, pets, pools, janitorial services, and maintenance.

The Zoning Code of the City of Antioch defines “dwelling unit” as “a room or a suite of interconnecting rooms used for sleeping, eating, cooking, and sanitation, designed or occupied for use as a separate quarters on a permanent basis for no more than one family and with.” For the purposes of the Rent Stabilization Ordinance, the exemptions required by State law apply even when the unit is owned by a corporate entity.

The maximum increase is the lesser of 3% or 60% of the most recent CPI. As a general rule of thumb, if the CPI is 5% or higher, the maximum rent increase is 3% of current rent. However, if CPI is lower than 5%, then the maximum increase amount is 60% of CPI. Staff is available to answer questions about the current maximum increase and the resulting increase amount in dollars when applied to a particular current rent amount. An explanation of how to calculate these numbers yourself is below.

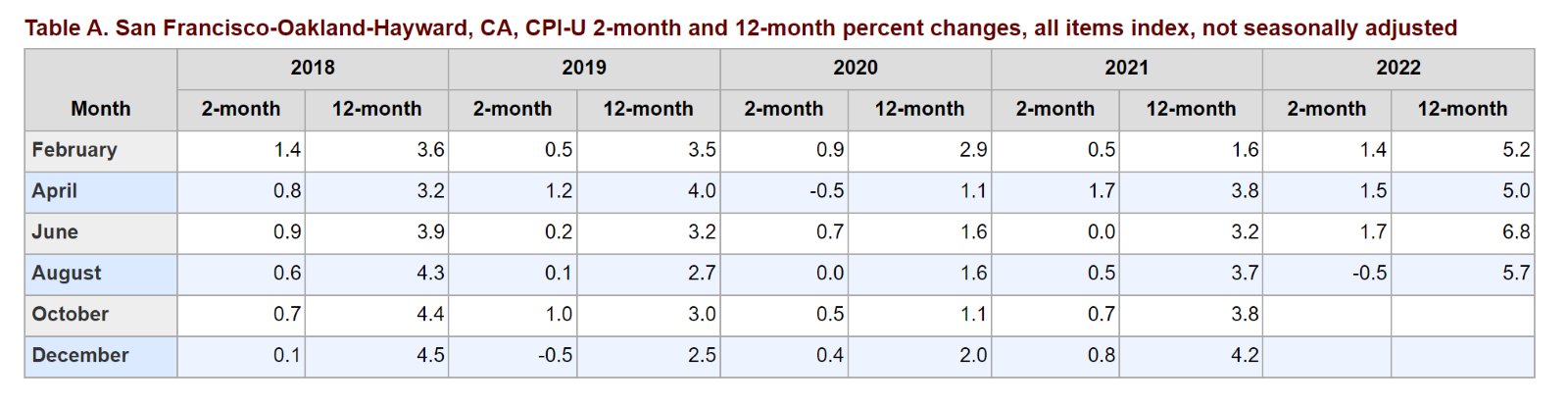

Using the example above, one way to calculate 60% of 5.7% (the most recent 12-month percent change in the example table) is to remove the percent signs and divide each number by 100 (60/100 = .6 and 5.7/100 = .057), and multiply those numbers together (.6 x .057 = .0342).

To turn this decimal number into a percent number, multiply the number by 100 and add a percent sign (3.42%). Since 3.42% is higher than 3%, the maximum rent increase would be 3%.

To calculate the maximum increase of the current amount, turn 3% into a decimal number by dividing it by 100 (3/100 = .03), and multiply this number by the amount of current rent. For example, if current rent is $2,000 per month, the maximum increase amount would be $60 (2,000 x .03 = 60). This would mean the amount of the increased rent could not exceed $2,060 per month for the next twelve months.

Some calculators, such as the calculator on an iPhone, have a button with the % sign. Typing in a percent number and tapping the % button will convert the number into a decimal number. There are also website calculators that may be useful in calculating 60% of CPI and the maximum increase amount for a particular current rent amount.

The “Consumer Price Index for All Urban Consumers” is an index published by the Bureau of Labor Statistics that measures the average change over time in the prices paid by urban consumers for goods and services. This index is often used as a measurement of inflation. The Bureau of Labor Statistics publishes indexes for certain metropolitan and regional areas, one of which is the “San Francisco-Oakland-Hayward Area.” This index measures changes in prices on a more local level and more closely reflects inflation experienced by City residents and property owners. The Consumer Price Index for All Urban Consumers for the San Francisco-Oakland-Hayward Area can be found on the Bureau of Labor Statistics website: https://www.bls.gov/regions/west/news-release/consumerpriceindex_sanfrancisco.htm#tableA.

The Bureau of Labor Statistics publishes the Consumer Price Index for All Urban Consumers for the San Francisco-Oakland-Hayward Area (“CPI”) for the months of February, April, June, August, October, and December of each year. For each of these months, the updated information is usually published 10 days after the month ends. The relevant number for the purposes of the Rent Stabilization Ordinance is the most recent 12-month percent change. In the example below, the “most recent 12-month increase” is 5.7% for August 2022.

The Rent Stabilization Ordinance limits rent increases in two ways. First, it limits rent increases to no more than one time in any 12-month period. Second, it establishes a limit on the amount rent may be increased. The amount of any rent increase may be no more than 3% or 60% of the most recent 12-month percent change in the Consumer Price Index for All Urban Consumers in the San Francisco-Oakland-Hayward Area (“CPI”) published by the Bureau of Labor Statistics, whichever is less, of the rent charged at the time of the increase.

In other words, rent may be increased if it has been at least 12 months since the last rent increase and the rent increase amount does not exceed the limit. The rent increase amount is the difference between the rent charged before the increase and the rent that would be charged after the increase. That increase amount cannot exceed the lesser of 3% or 60% of the CPI of the rent charged at the time the increase is noticed or requested. As a general rule of thumb, if the CPI is 5% or higher, the maximum rent increase is 3% of the current rent. If the CPI is lower than 5%, the maximum rent increase will be 60% of the CPI of the current rent.

If a tenant believes their landlord has demanded, accepted, or retained rent that is higher than the maximum amount allowed under the RSO, tenant may file a Rent Reduction Petition pursuant to the procedure in Section 11-1.06 of the Antioch Municipal Code. The process begins by filling out a Rent Reduction Petition form from the City and submitting it to the City with a copy to the landlord. The tenant will need to provide enough information—including the type of dwelling, dates of tenancy, dates of rent increases, amount of rent increases, dates of charges, and amounts of charges—to prove a rent reduction is necessary to comply with the RSO. A hearing officer will review the Rent Reduction Petition and additional information provided by the tenant and landlord, if any, and decide whether the rent should be reduced.

The list of rental units exempted from the Rent Stabilization Ordinance is found in Section 11-1.08 of the Antioch Municipal Code. If a rental unit is exempt, the restrictions and requirements of the RSO do not apply to tenancies of that unit.

State law requires the City to exempt:

- Any dwelling unit that first received a certificate of occupancy after February 1, 1995; and

- Any dwelling unit that does not share a parcel with another dwelling unit, such as a single family home without an ADU, or that may be sold separately from any other dwelling unit, such as a condo or a co-op;

The Rent Stabilization Ordinance also exempts the following:

- A unit owned, operated, or managed by a public agency

- A unit is specifically exempted from municipal rent regulation by law

- Mobile homes located in mobile home parks;

- Hotels, vacation rentals, and other properties used for short-term rentals of no more than 30 days

- Institutional facilities, such as hospitals, residential care facilities, and school dormitories

- A unit occupied by a Landlord or the Landlord’s family at the beginning of, and throughout, the tenancy; and

- A unit that shares the bathroom or kitchen facilities with a principal resident of a Landlord.

Please see Section 11-1.08 of the Antioch Municipal Code for the complete list of exemptions.

If a unit is exempt, it is not subject to the registration and notice requirements of the RSO.

Yes. There are differences between the California Tenant Protection Act (AB 1482) and the Rent Stabilization Ordinance due to State law restrictions and local policy objectives. Units exempt from the RSO may be protected by AB 1482. Some of the key differences between the two are highlighted below.

| AB 1482 | RSO |

| Exempts dwelling units that first receive a certificate of occupancy within 15-years, which is applied on a rolling basis | Exempts dwelling units that first received a certification of occupancy after February 1, 1995 |

| Exempts units if they are restricted to be affordable for low- or moderate-income residents, which can included privately-owned and deed-restricted affordable housing | Exempts units owned, operated, or managed by a government agency or that are exempt from local rent regulation by law, but does not exempt affordable housing with only deed restriction |

| Does not exempt single family homes that are owned by certain entities | Exempts single family homes regardless of ownership |

| Exempts duplexes if one is the owner’s primary residence at the beginning and throughout the tenancy | Does not exempt duplexes regardless of owner-occupation of second unit |

The RSO does not apply to a single family home unless (1) it was first issued a certified of occupancy on or before February 1, 1995 and (2) it shares a parcel with another unit, such as an accessory dwelling unit.

If both of these things are true, the RSO applies unless one of the other narrow exceptions apply, such as the unit shares a bathroom or kitchen facilities with the Landlord’s principle residence or the unit is occupied by a Landlord or the Landlord’s family.

The RSO applies to an accessory dwelling unit unless it was certified for occupancy after February 1, 1995. The RSO does not provide an exemption for Landlord occupancy of another unit on the property.

The RSO applies to a duplex or triplex unless it was certified for occupancy after February 1, 1995. The RSO does not provide an exemption for Landlord occupancy of another unit of a duplex or triplex.

The RSO is designed to protect a landlord’s constitutional right to a “fair return” on their investment. Section 11-1.07 of the Antioch Municipal Code details the procedure for submitting a Fair Return Petition to the City for consideration of permitting a rent increase in excess of the rent increase limit under the RSO. This procedure includes providing a copy of the Fair Return Petition to the tenant and allowing 30 days for the tenant to respond and provide additional materials to the City. The procedure also requires the landlord to pay for the cost of the proceeding. A hearing officer will determine whether an increase in excess of the limit is justified to maintain a fair return.

Every Fair Return Petition will be decided on a case-by-case basis. It is possible that a hearing officer may determine that a higher increase is needed to maintain a fair return for a landlord that was charging less than they could have charged before the RSO took effect. However, there is no right to maximum profit, and rent charged prior to a regulation like the RSO tends to indicate a landlord was satisfied with the amount of profit made from the lease.

The RSO is designed to protect a landlord’s constitutional right to a “fair return” on their investment. Section 11-1.07 of the Antioch Municipal Code details the procedure for submitting a Fair Return Petition to the City for consideration of permitting a rent increase in excess of the rent increase limit under the RSO. This procedure includes providing a copy of the Fair Return Petition to the tenant and allowing 30 days for the tenant to respond and provide additional materials to the City. The procedure also requires the landlord to pay for the cost of the proceeding. A hearing officer will determine whether an increase in excess of the limit is justified to maintain a fair return.

Every Fair Return Petition will be decided on a case-by-case basis. Subdivision (B) of Section 11-1.07 of the Antioch Municipal Code lists examples of factors a hearing officer may consider when making a decision on a Fair Return Petition, including capital improvements arising after a tenancy began. Where approved, the calculation of certain capital improvement expenses will be averaged on a per-unit basis and amortized over at least five years.

If you have additional questions about the rent stabilization program, please email RentProgram@antiochca.gov.